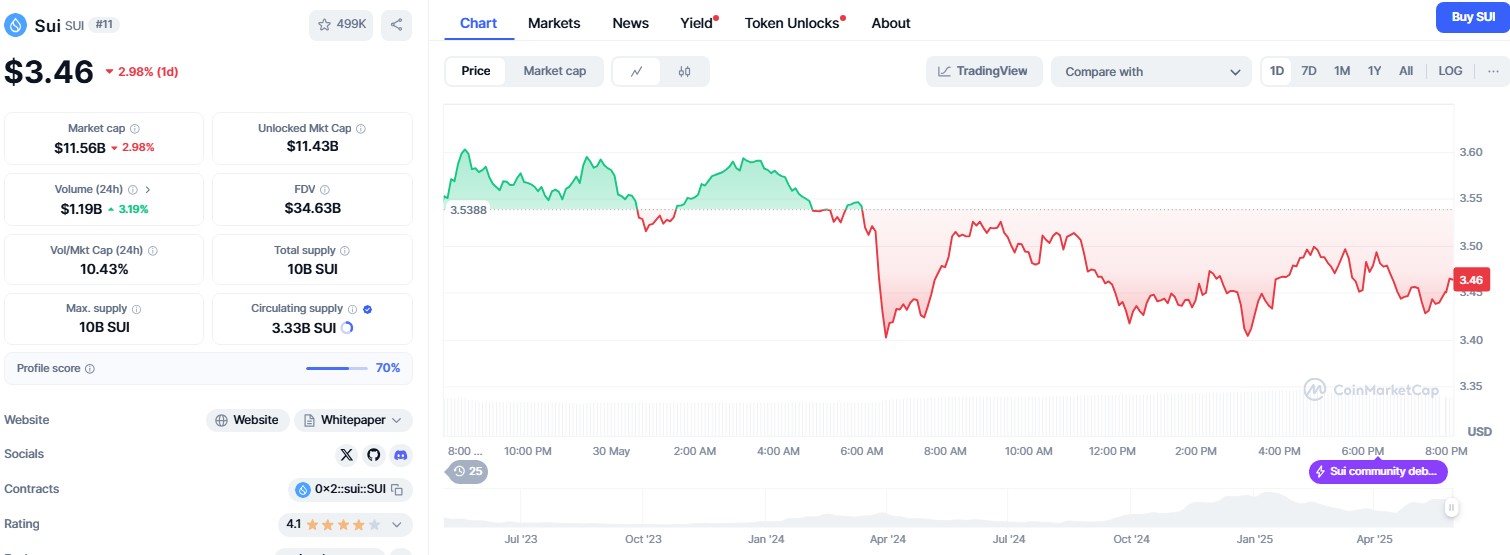

The native token of the Sui blockchain, SUI, is regaining market attention. Trading at $3.46 on May 30, it remains below its recent high of $4.18, but analysts foresee a potential rally toward $10.

CETUS Recovery Vote Restores Trust

A $223 million exploit on CETUS Protocol triggered a sharp drop in SUI. About $162 million was frozen through validator coordination. While SUI hit a low of $3.32, sentiment improved as over 90% of stakers and validators approved the return plan.

The token held above the 50-day EMA. Technicals indicate a bull flag pattern, signaling continued bullish potential.

ETF Speculation Attracts Institutional Eyes

21Shares and Canary filed for spot SUI ETFs, increasing hopes for regulated access to SUI. If approved, institutions could gain exposure to SUI directly—boosting liquidity and stability.

With Paul Atkins leading the SEC, no altcoin ETFs have been approved yet, but decisions on LTC, XRP, and ADA are expected soon. This places SUI in the spotlight.

Crypto analyst Crypto Bullet noted a potential “parabolic move” that could send SUI above $10, citing a completed Wave 2 and a brewing Wave 3 rally.

Technical Targets: $5.37 Within Reach

Resistance lies at $3.945 and $4.8587. If momentum persists, SUI could revisit its all-time high of $5.37.

However, upside depends on sustained ETF optimism and CETUS’s successful execution of its recovery. SUI remains under $3.50 for now, but conditions may be ripe for a rally.