Medical technology company Semler Scientific continues to expand its Bitcoin portfolio. With a $20 million investment to acquire 185 BTC between May 23 and June 3, the company has increased its total reserves to 4,449 BTC, purchased at an average price of $107,974 per coin.

According to official documents filed with the SEC on June 4, Semler’s total Bitcoin investment now exceeds $410 million, with a market value of approximately $473 million as of June 3. The company’s aggressive accumulation strategy initiated in May 2024 has already yielded 26.7% returns.

Semler has been making regular Bitcoin purchases throughout the past year, including a $10 million acquisition between February-April and a $50 million purchase in May.

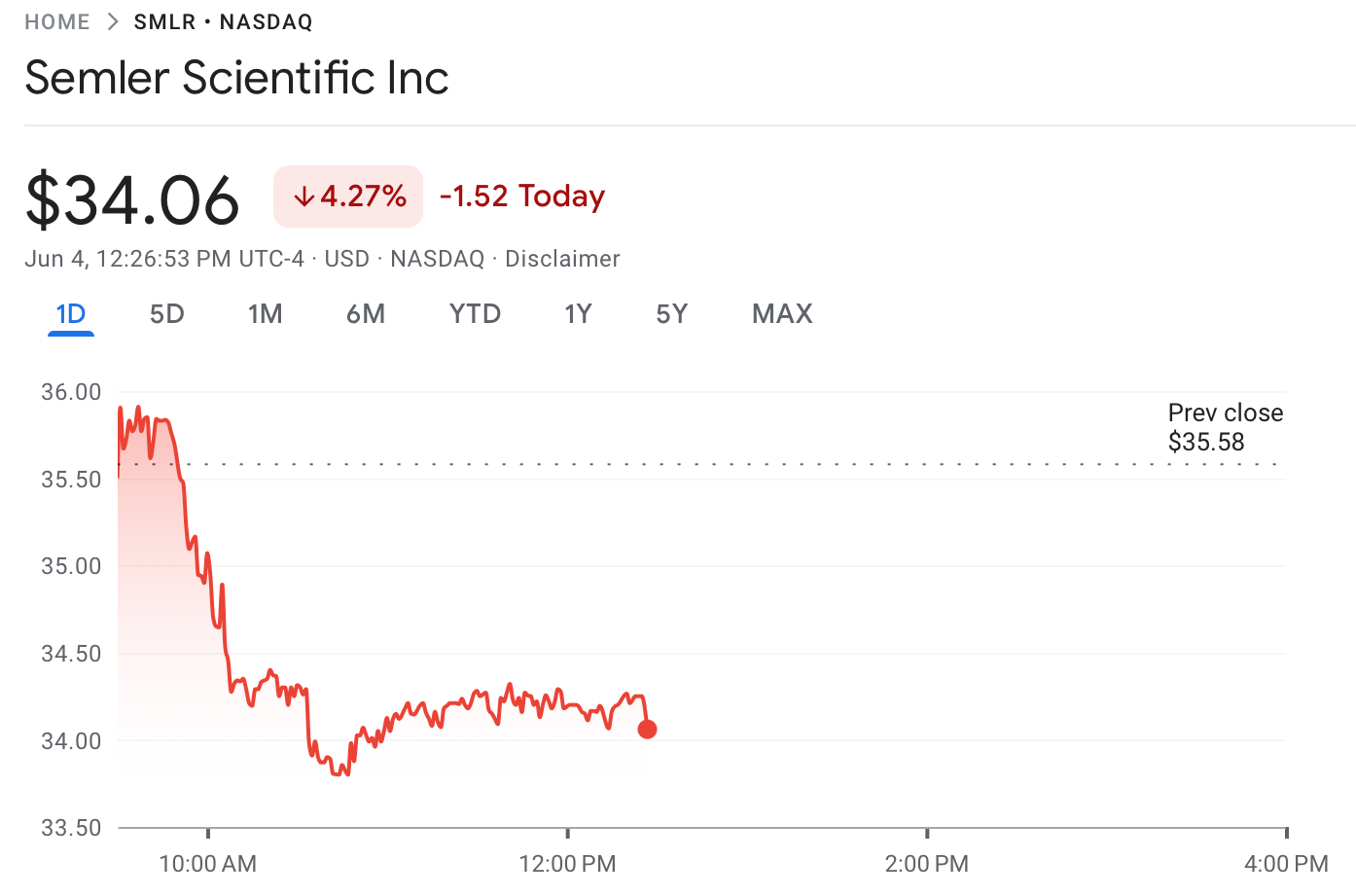

However, these moves haven’t attracted investor interest as expected. While shares have rebounded 16% since the Bitcoin reserve announcement on May 29, 2024, they’re still down 37% year-to-date in 2025.

Mixed Performances Among Bitcoin-Focused Companies

Companies holding Bitcoin on their balance sheets show varied stock performances this year. MicroStrategy (MSTR) shares have gained 33% year-to-date, while Japan-based Metaplanet’s shares recorded an extraordinary 265% surge.

The crypto market has experienced intense volatility in 2025. After reaching an all-time high of $112,000 with an 11.8% yearly increase, BTC retreated to $77,000 levels due to macroeconomic uncertainties.

BitcoinTreasuries data shows that global corporate and government Bitcoin reserves now exceed 3.4 million BTC. While ETFs and public companies hold the majority of these reserves, sovereign nations rank third.